Key Highlights

- 1 CEA for Post Office Employees 2024: Complete Guide to Benefits, Eligibility & Claims

- 2 What is the CEA For Post Office Employees?

- 3 Key Highlights of CEA for Post Office Employees in 2024:

- 4 Eligibility Criteria for Children’s Education Allowance in 2024 For DOP Employees

- 5 Provisions for Disabled Children in CEA 2024

- 6 What Expenses Are Covered Under CEA in 2024 For The Post Office Employees?

- 7 How to Claim Children’s Education (CEA) Allowance in 2024 For Post Office Employees

- 8 Important Documents Used to Submit the CEA Form for Postal Employees

- 9 Conditions for Reimbursement of CEA

- 10 FAQs on Children’s Education Allowance, CEA for Post Employees in 2024

- 11 Conclusion: CEA for Post Office Employees 2024

CEA for Post Office Employees 2024: Complete Guide to Benefits, Eligibility & Claims

CEA for Post Office Employees 2024: Children’s Education Allowance i.e. CEA is a critical support through the government of India where all the employees in its service, such as from the Department of Post Office, are considered eligible under its schemes. Because of the high increasing cost for education expenses, this allowance brings all this into a system by reducing the family burden when providing the best possible to the child. This guide covers everything that you need to know about the 2024 CEA program-from eligibility criteria and benefits to documentation and claiming procedures.

What is the CEA For Post Office Employees?

Children’s Education Allowance, CEA for Post Office Employees is a government benefit in the Indian Income Tax Act that helps employees of the government with children’s education expenses. Such expenses include school fees, uniforms, books, and transport, which make education more accessible. CEA is available for Post Office employees and other central government employees and is particularly useful for those whose children are in primary and secondary schools.

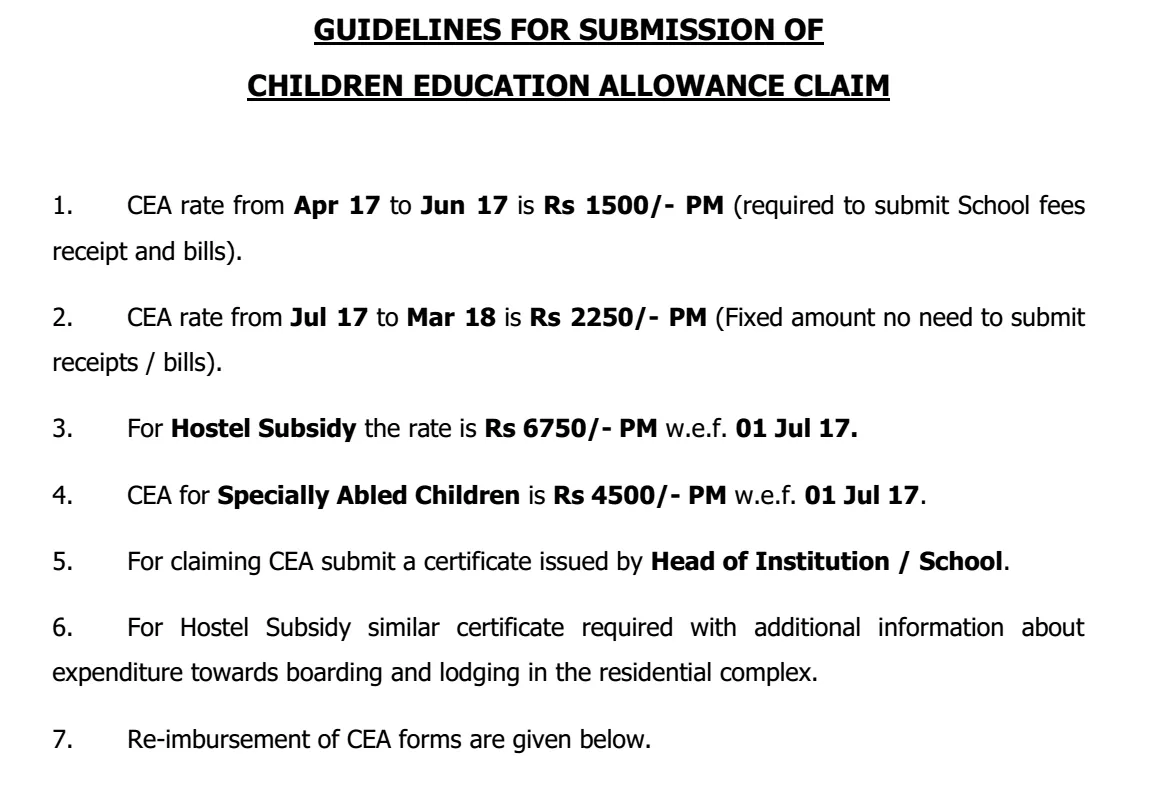

Key Highlights of CEA for Post Office Employees in 2024:

- Claim up to two children eligible and is exempted only when it is twin / twin births after the birth of the first child.

- A wide range of expense made in education is also liable to be reimbursed

- The reimbursement done annual basis or bi annual, based on the orders.

- Special provision with handicapped children.

Here is the Tabular Form in gist.

| Topic | Key Points |

|---|---|

| What is CEA? | Government-funded education allowance |

| Eligibility | Up to two children per eligible employee |

| Maximum Age | 20 years (non-disabled), 22 years (disabled) |

| Annual Reimbursement Limit | ₹27,000 per child, double for disabilities |

| Covered Expenses | Tuition, uniforms, books, stationery, transport |

| Excluded Expenses | Private tuition, extracurricular activities |

| Claim Process | Submit CEA form with receipts to HR |

| Required Documentation | Original receipts, school certificates |

| Tax Exemption | Section 10(14) of Income Tax Act |

| Special Provision for Disabilities | Higher reimbursement for disabled children |

| Claim Period | Typically claimed annually |

Eligibility Criteria for Children’s Education Allowance in 2024 For DOP Employees

In 2024, who is eligible to file claims for CEA?

1. Regular Employees of Department of Post: The CEA is available for the regular employees of Department of Post.

2. Children Count: CEA is granted for 2 (two) children, although exceptions are permitted for case of twins or more babies after the first child; however, the benefit would be only for the twins or more babies, but not for the first one.

Latest News

3. Age Eligibility:

- In the case of regular children, their age should not be beyond 20 years to receive the eligibility.

- For disabled children, the age is increased to 22 years of age, as there are additional educational requirements.

Provisions for Disabled Children in CEA 2024

The CEA pays extra charges if the child is disabled, such as attending special schools and needs assistance. Claims under this are supported with evidence of disability and additional costs. It also attracts a higher reimbursement rate.

What Expenses Are Covered Under CEA in 2024 For The Post Office Employees?

Children’s Education Allowance is designed to cover a significant number of essential educational expenditures. The following is the general outline of what is covered under CEA.

1. Tuition Fees: A tuition fee for primary, secondary schooling, and school fees for pre-primary or nursery schooling are reimbursed by CEA.

2. Uniforms: The cost incurred on winter and summer school uniforms is also covered.

3. Books and Stationery: The cost of textbooks, workbooks, and other stationery items for the school curriculum is also paid under reimbursement.

4. Transport: School bus or transportation fees from home and school are also paid under CEA.

5. Special Needs Expenditure: If a child is disabled, then there are special costs on account of special educational needs.

Also Read, PA SA Recruitment Amendment Rules 2024: Key Updates and Positive Changes for Aspiring Candidates

Maximum Reimbursement Limit

The children education allowance under CEA will be reimbursed up to ₹2,250 per child per month as of 2024. That amount will cover expenses up to ₹27,000 annually per child. But the amount can be doubled for children with disabilities according to the educational needs.

How to Claim Children’s Education (CEA) Allowance in 2024 For Post Office Employees

Reimbursement of CEA to the employees in Post Office shall follow specified procedures and provision for essential documentation. Here’s the step-by-step procedure in claiming your CEA.

Step 1: Collection of Receipts and Other Supporting Documents

Receipts or bills for the legitimate cost of education, for school fees, uniforms, books, and transportations costs shall be collected and listed by date and category. They shall also ensure that documents collected pertain only to those falling within the school year subject to allowance claim.

⇒ Download the Submission CEA Form From here

Step 2: Fill up the CEA Claim Form

The Department of Post provides a common CEA claim form to be filled up by Post Office employees. The form will seek elementary details about the child, which include:

- Child’s name and age

- Class or grade in which he is studying

- Expenses incurred with details

Step 3: Submission of Relevant Documents

Original receipts, bills, or fee slips must accompany the CEA claim form with the employees. The receipts should be valid, dated, and bearing the official seal of the school. For handicapped children, some other documents or certificates stating the nature and extent of disability may be needed.

Step 4: Send to the Department of Post Office

All such completed forms and documents must be submitted to the respective administrative office or departmental HR in the Department of Post. Copies of all documents submitted are suggested to carry along for personal references

Step 5: Clearance and Reimbursement

The Department of Post, subsequently processes and examines the claim submitted after the claim has been made. It usually happens that the CEA-approved amount is allowed being credited to the account of the salary of the respective employee.

Claim Period

Most departments accept CEA claim submissions once a year while others may allow twice, so you have to first check the reimbursement frequency which is stated in your departmental HR policy.

Important Documents Used to Submit the CEA Form for Postal Employees

To justify a CEA claim a number of documents are necessarily required to validate the spend. These are as given below:

- 1. Receipts and Invoices Raised by the School: Admission fees, transport fees, uniforms, and books.

- 2. School Certificate: Some departments ask for a certificate from the school the child is studying in and the expenses incurred.

- 3. Disability Certificate: If the child suffers from any kind of disability, then a certificate from some competent medical authority to prove the nature of disability is needed.

All these documents should be kept ready and well-arranged so that the process of reimbursement takes less time and the possibilities of any claim being rejected due to lack of information are at a minimum.

Conditions for Reimbursement of CEA

Reimbursement for CEA for the employees in Post Office has certain conditions or rules attached to it. Here are a few extremely important points:

1. Two-Child Rule: Benefits are generally available only on two children. Exceptions come only for twins or more than one birth after the first child.

2. Education Level: The CEA provides education allowance from pre-primary to the secondary level. In other words, it does not allow higher education expenses so that one cannot claim the colleges and university expenses.

3. Tax Implications through Income Tax: As discussed above, under Section 10(14) of the Income Tax Act, the allowance for children’s education is exempted by the government up to a specified limit. This saves the income of an employee from paying tax so that he could support the education of his children.

4. Extra co-curricular activities without which no one can survive these days, such as sports coaching, dance classes, and other private tuitions. Their expenses are not considered within the CEA.

FAQs on Children’s Education Allowance, CEA for Post Employees in 2024

1. What is the maximum amount that I can claim under the CEA?

Maximum CEA that may be claimed per child is ₹ 27,000 per annum and for disabled children it shall be double the said limit.

2. Do I get CEA for more than two children?

No, since the CEA is only applicable up to two children; with a special exception applied to multiple births or twins after the first child.

3. Does tax exemption apply to CEA?

Yes, the CEA attracts tax exemption under Section 10(14) of the Income Tax Act, up to the limits applied by the government.

4. Is CEA available if my child will be attending a private school?

Yes, neither public nor private school make any difference as long as the school is recognized, and the expenses qualify on allowance.

5. In case my child has disabilities?

Provisions for disabled children are two times the amount of the allowance. All these claims must be supported with evidence, one of which is a medical certificate that states the kind of disability.

Conclusion: CEA for Post Office Employees 2024

The Children’s Education Allowance for Department of Post employees is an important support mechanism in helping families manage the cost of schooling from primary to secondary education. In this way, CEA not only covers various educational expenses but also helps in educating the children of government employees.

In terms of CEA for Post Office Employees in 2024, it would be a tremendous benefit to know about CEA guidelines and procedures related to claims. Getting original receipts, properly filling in the claim form, and submitting it within the correct date will help in the utilization of maximum benefits of the CEA program for the employees in Post Office. Increasing education costs every day makes the CEA program one of the significant benefits to the government employees so that the children can enjoy quality education without any burden.

1 thought on “CEA for Post Office Employees 2024: Complete Guide to Benefits, Eligibility & Claims”