Key Highlights

- 1 Clearing Debit/Credit Balances in PPF Transit Account by Post Offices Government of India issues directive

- 2 Background of the Directive

- 3 Key Observations : Clearing Debit/Credit Balances in PPF Transit Account

- 4 Actionable Directives for Circles on Clearing Debit/Credit Balances in PPF Transit Account

- 5 Significance of the Directive

- 6 Conclusion: Clearing Debit/Credit Balances in PPF Transit Account

Clearing Debit/Credit Balances in PPF Transit Account by Post Offices Government of India issues directive

Clearing Debit/Credit Balances in PPF Transit Account by Post Offices:

Date: November 12, 2024

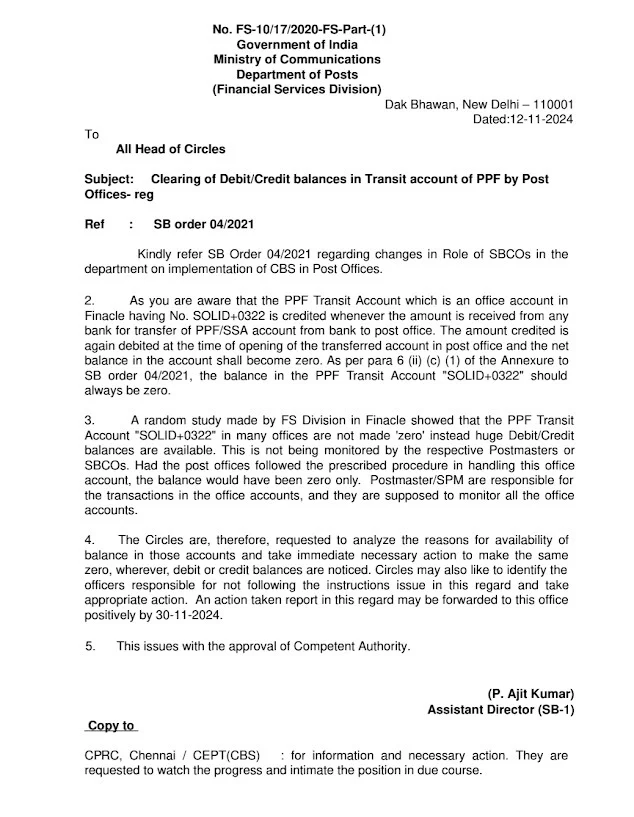

Source: Ministry of Communications, Department of Posts

Ministry of Communications, Department of Posts, to regulate the credit/debit balance management in the PPF Transit Account used by post offices, has brought out an order that goes to address issues that were found regarding the operation of office accounts in the core banking solution Finacle used by India Post. The circulated order is through Letter No. FS10/17/2020FSPart(1) and approved by the competent authority, again emphasizes that procedures as prescribed under financial procedures have to be adhered to at all levels along with accountability.

Background of the Directive

The matter relates to the PPF Transit Account (Account No. SOLID+0322), being an office account in Finacle.

Latest News

Accounts are very important, particularly when transferring Public Provident Fund (PPF) and Sukanya Samriddhi Account (SSA) deposits from banks to post offices.

As per procedural guidelines received in SB Order 04/2021, when money is received from the bank in this account, it is credited and debited upon opening of account successfully in a post office. Ideally, this account should never lose or gain anything, ideally at a zero balance, showing that there has been a smooth transfer of funds.

But the FS Division announced remarkable deviations from such protocol by a study. Many instances involve considerable debit or credit balance in the PPF Transit Account, and this seems to indicate non-compliance with the directives that have existed.

Key Observations : Clearing Debit/Credit Balances in PPF Transit Account

1. Non-zero Balances in PPF TRANSIT accounts

The FS Division, however, adds that on so many occasions, zero balance should not have been in the transit account in those post offices which indeed reflects the lack of proper monitoring and management by concerned Postmasters and SPMs.

2. Accountability Issues

Responsibility for these discrepancies lies with Postmasters and SBCOs (Savings Bank Control Organizations), whose roles include monitoring transactions and ensuring accurate management of office accounts. Noncompliance in handling the PPF Transit Account has raised concerns over accountability and adherence to procedural mandates.

Also Read, Merger of PA SBCO and PA PO Cadres: Last Chance for the upgrade for PA (SBCO) Officers in 2024

Actionable Directives for Circles on Clearing Debit/Credit Balances in PPF Transit Account

The Department has issued the following instructions for postal circles for reconciling these differences:

1. Analysis and remediation:

Circles are requested to scrutinize the reasons behind zero non-zero balance of PPF Transit Account. The adjustment should be done immediately to show that such accounts balance at zero.

2. Accountability of Officers:

Circles will identify erring officers who do not follow prescribed procedures. Proper disciplinary or corrective actions must be applied against erring persons.

3. Filing of Action Taken Report:

Circles will present an Action Taken Report to the Financial Services Division by 30 November 2024.

Significance of the Directive

This proposal has been initiated with the aim of strengthening responsibility and efficiency in financial management at India Post. With zero balances in PPF Transit Accounts, the department could look forward to increased accuracy in transactions and acceptability with public trust on postal savings schemes.

Implementation and Monitoring:

The policy also requires the association to discuss major technical and administrative bodies:

- CPRC, Chennai: To monitor the completion and rectify discrepancies in a timely manner.

- CBS-CEPT: The institution shall provide technical support and monitor compliance.

Both will also have to report at any time the status of implementation to the Department of Posts.

Conclusion: Clearing Debit/Credit Balances in PPF Transit Account

The Department of Posts guideline puts into focus the imperative duty of procedural discipline and financial accuracy in managing public funds. As India Post steers ahead with the modernization and improvement in its services, the strict observance of financial protocols remains to be an indispensable element in guaranteeing excellence in operations as well as instilling the trust of the very vast customer base. Detailed instructions and procedural guidelines are provided; one may download them in PDF format to refer to the directive and its annexures.

Issued By: P. Ajit Kumar

Assistant Director (SB-1)

Department of Posts,

Finance Division Dak Bhawan,

Sansad Marg New Delhi

For more updates related to India Post Guidelines and Services, visit PostalCorner.in