Key Highlights

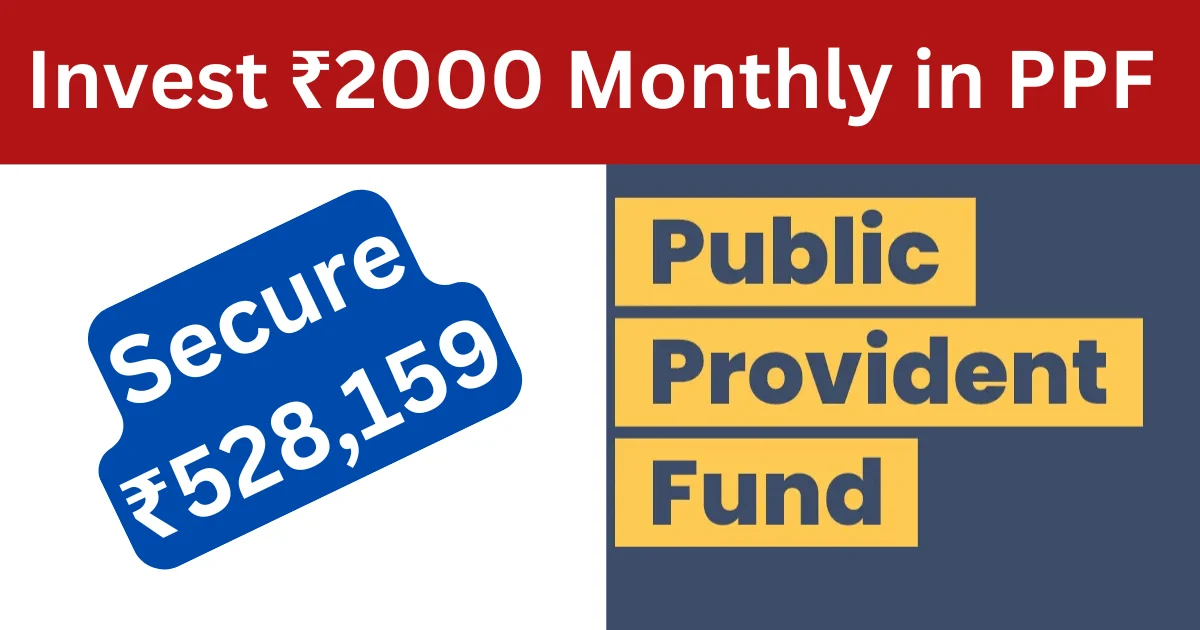

Invest ₹2000 Monthly in PPF and Secure ₹528,159 Now for Your Future!

Invest 2000 Monthly in PPF: PPF is India’s long-term, government-backed savings facility-a highly safe avenue to save and accumulate money. The returns under it are tax-free, compounded annually, with a tenure of 15 years. Millions of Indians have been investing in PPF over the years. But what happens if you start investing ₹2000 every month in the PPF account? Let’s understand the benefits and returns so that we know why it might be a perfect investment for you in 2024.

How Does ₹2000 Monthly Investment in PPF Work?

PPF enables investing in any amount ranging between ₹500 and ₹1.5 lakh per year. You may invest ₹24,000 in one year by depositing ₹2000 every month. Such a small amount won’t necessarily draw much attention at the onset, but when compounded together with tax-free interest rates, it builds up quite a corpus.

1. Tax Benefits That You Can’t Ignore

One of the significant reasons for people to invest money in PPF is for the benefit of tax saving under Section 80C of the Income Tax Act. Contributions by you up to ₹1.5 lakh for your PPF account are eligible for tax benefit. Contribution of ₹24,000 every year if one invests ₹2000 every month will be tax deductible resulting in lower tax liability on this income.

The interest garnered on the PPF balance is also tax-free, and therefore, there is no tax payment on the interest so accrued. This makes it one of the most rewarding saving instruments for tax planning.

2. Compounding: Your Wealth Grows Much Faster Than You Think

The interest earned is compounded annually, thereby earning interest upon interest. The interest rate currently available under the PPF scheme has stood at 8.2% per annum, compounded annually as of 2024. Even though such percentages fluctuate from time to time, it has been rather stabilized and competitive vis-a-vis other savings schemes existing in the market.

Latest News

Let’s see how your ₹2000 monthly contribution would work in a PPF account with an annual compounding.

Example Calculation:

- Monthly Contribution: ₹2000 By the end of Year 12, that’s ₹24,000

- Interest Rate: 8.2% (compounding annually)

- Investment Tenure: 15 years (minimum duration for PPF)

Now, here’s an approximate calculation of the corpus you can accumulate by investing ₹2000 every month in PPF:

| Year | Investment | Interest Earned (Approx.) | Total Balance (Approx.) |

|---|---|---|---|

| 1 | ₹24,000 | ₹1,970 | ₹25,970 |

| 3 | ₹72,000 | ₹8,104 | ₹80,104 |

| 5 | ₹120,000 | ₹20,160 | ₹140,160 |

| 10 | ₹240,000 | ₹69,992 | ₹309,992 |

| 15 | ₹360,000 | ₹168,159 | ₹528,159 |

By the time you attain the age of 15 years you would have saved ₹360,000 in your PPF account. However, the absolute amount could touch about ₹528,159 depending on the prevailing interest rate at that time.

Calculate Your savings Scheme Now

3. Assured Returns: No Market Risks

What is probably the most attractive aspect about investing in PPF is that it is a totally risk-free government-backed investment. This means that it is completely risk-free to market fluctuations. Your returns, unlike in investment in the stock or mutual funds, depend on what goes on with the market. Returns from PPF come assured by the Indian government. One doesn’t have to worry about sudden dips or crashes that always come with the market, hence ideal for risk averse investors.

4. Loan Facility Against PPF Balance

PPF account does have another peculiar feature in the form of a loan facility. You can withdraw loan against your PPF balance once you have invested for 3 years in PPF.

- You may withdraw up to 25% of the sum at the end of the second year

- The interest on loans is lower than personal loans, so it becomes an attractive option when you are in an emergency.

- In case you suddenly require some emergency money, your PPF account may be used as a source of liquidity.

5. Withdrawals and Partial Withdrawals

However, PPF is a very long term investment, after the sixth year, withdrawal with some facility is allowed there as well, so you need not sacrifice the long-run benefit during emergencies.

On completion of the 15year tenure, the option to withdraw the entire balance or extend the tenure in blocks of 5 years with or without adding contributions is available.

Why ₹2000 Per Month is the Ideal Investment Amount?

- Affordability: ₹2000 happens to be the amount that most middle-class families can afford to invest each month without having to compromise their other financial obligations.

- Flexibility: You can increase your monthly investment (within the ₹1.5 lakh annual limit) as your income rises with time.

- Long-Term Growth: A regular investment of ₹2000 too can grow into a significant corpus due to compounding over 15 years.

Saving for Your Future: How Does PPF Work?

Thus, you will be conserving your current tax benefits and securing your future fund. If it runs beyond 15 years, you may be staring at a total balance that can become sizeable enough to become a portion of your retirement corpus.

Imagine having guaranteed tax-free money while in your retired years. For many Indians, this PPF account serves as a retirement corpus – safe and mind-assuring.

Conclusion: Invest ₹2000 in PPF Now for a Safe Tomorrow!

PPF is still a reliable and sensible choice if proper wealth creation over time can be inculcated for the future in an uncertain world. You are saving ₹2000 every month through investments that also reap your money for you in the form of assured returns and tax-free interest.

Invest in PPF today itself so that you not only earn an interest rate over time but also gain security that your money is saved and growing steadily. The sooner you begin investing, the higher is the impact of compounding, and the brighter your future is sure to be. Whether it is for retirement, children’s education fund, or just as a rainy day safety net, PPF should feature in your investment plan for the year 2024.